The UK minimum wage 2025 is set to rise from 1 April 2025, marking one of the most significant increases in recent years. This change affects workers across all age groups, including apprentices, and is designed to reflect the rising cost of living while narrowing the gap between different age categories. The government has confirmed that the National Living Wage and all other minimum wage bands will increase, following recommendations from the Low Pay Commission.

What Are the New Rates?

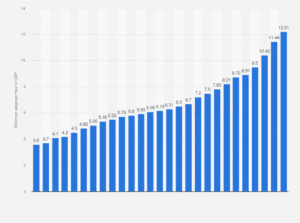

From April 2025, the minimum wage for those aged 21 and over, known as the National Living Wage, will rise to £12.21 per hour, up from £11.44. Workers aged 18 to 20 will see their hourly rate jump to £10.00, compared with the previous £8.60. The rate for 16 to 17 year olds will rise sharply to £7.55, up from £6.40. Apprentices, who were also previously on £6.40 per hour, will now earn £7.55 if they are under 19 or in the first year of their apprenticeship.

Even the accommodation offset — the maximum amount an employer can deduct from wages if accommodation is provided — will increase, moving from £9.99 per day to £10.66 per day. These increases, while different in percentage terms, all represent a meaningful boost to take-home pay, particularly for younger workers who are benefiting from the largest percentage gains.

Who Qualifies for the UK Minimum Wage 2025?

Eligibility under the UK minimum wage 2025 rules is clear but often misunderstood.

Workers aged 21 and over are entitled to the full National Living Wage rate. Those aged 18 to 20 qualify for their own band, while 16 to 17 year olds, provided they are above school leaving age, receive their own lower rate. Apprentices under the age of 19 or in the first year of their apprenticeship qualify for the apprentice rate, but once they complete the first year and are over 19, they move up to the minimum wage rate for their age group.

There are, however, groups who are not covered by the new rates. People under school leaving age do not qualify, nor do volunteers, company directors, or those on certain government-funded training schemes. More details on who qualifies can be found on the government’s official minimum wage eligibility guide.

Why This Increase Matters

The UK government has made clear that the rise in the UK minimum wage 2025 is intended both to help with the cost of living and to narrow the historic pay gap between older and younger workers. While the National Living Wage for 21+ workers is going up by 6.7 percent, the increases for younger workers and apprentices are far more dramatic — in some cases over 16 or 18 percent.

This reflects a deliberate policy shift. For many years, younger workers were paid significantly less than their older counterparts. Now, the government is working toward reducing those disparities, particularly as living costs affect all age groups, not just those over 21.

Impact on Workers

For employees, the UK minimum wage 2025 offers clear benefits. A full-time worker aged 21 or over working 37.5 hours a week will see their weekly wage rise by more than £28 compared with the previous rate, amounting to almost £1,500 more per year.

Young workers and apprentices, who are often employed in retail, hospitality, and service sectors, will benefit even more in percentage terms. For instance, an apprentice previously earning £6.40 an hour will now be on £7.55, giving them an extra £46 for a standard 40-hour week. For young people starting their careers, this could make a huge difference to affordability, independence, and saving opportunities.

Impact on Employers

Employers, however, will face challenges. Increased payroll costs will affect sectors that rely heavily on lower-paid staff, such as care, hospitality, and agriculture. Smaller businesses in particular may struggle to absorb these costs, especially if they already operate on tight margins.

Employers will also need to ensure that payroll systems are updated before April 2025, and that deductions for things like accommodation do not breach the updated accommodation offset rate of £10.66 per day. Non-compliance with the UK minimum wage 2025 rules can result in penalties, fines, and reputational damage.

Sector-Specific Implications

The rise is likely to hit hardest in industries with large numbers of young staff, apprentices, or entry-level workers. Hospitality businesses, for example, often employ 18 to 20-year-olds and apprentices. Retail, customer service, and agriculture are also highly impacted.

On the other hand, the care sector — which has long struggled to recruit and retain staff due to low pay — may benefit from improved recruitment prospects if higher wages make roles more attractive.

Looking Beyond 2025

While the UK minimum wage 2025 is a milestone, discussions are already underway about future reforms. The government has signaled that it may eventually lower the age threshold for the National Living Wage even further, making it available to younger workers. There are also comparisons with the “Real Living Wage,” a voluntary higher rate calculated by the Living Wage Foundation. Many argue that the statutory minimum is still not enough to meet real household costs. You can learn more about the Real Living Wage at the Living Wage Foundation’s website.

Final Thoughts

The UK minimum wage 2025 is more than just a pay rise. For workers, it represents recognition of the need to keep pace with living costs. For younger workers and apprentices, the increases are especially significant, reducing the gap between them and older colleagues. For employers, however, it brings new financial pressures and the need to carefully review budgets and staffing.

Whether you are an employee looking forward to a bigger pay packet or an employer planning for higher payroll costs, it’s essential to understand the details of the new minimum wage rates. Compliance is not optional — and getting it right will benefit both businesses and workers in the long run.

Read more latest news at SwiftReportNow